Credit Score Trends

Average FICO® Score 8

Average U.S. FICO® Score Slightly Decreases to 714 in 2024

Recent data indicates that the average U.S. FICO® Score is now around 714, a slight decrease from 716 in 2022. Experts attribute this to evolving consumer borrowing behaviors, rising interest rates, and inflationary pressures. Despite a minor dip, scores continue to hover in the ‘good’ range for many Americans.

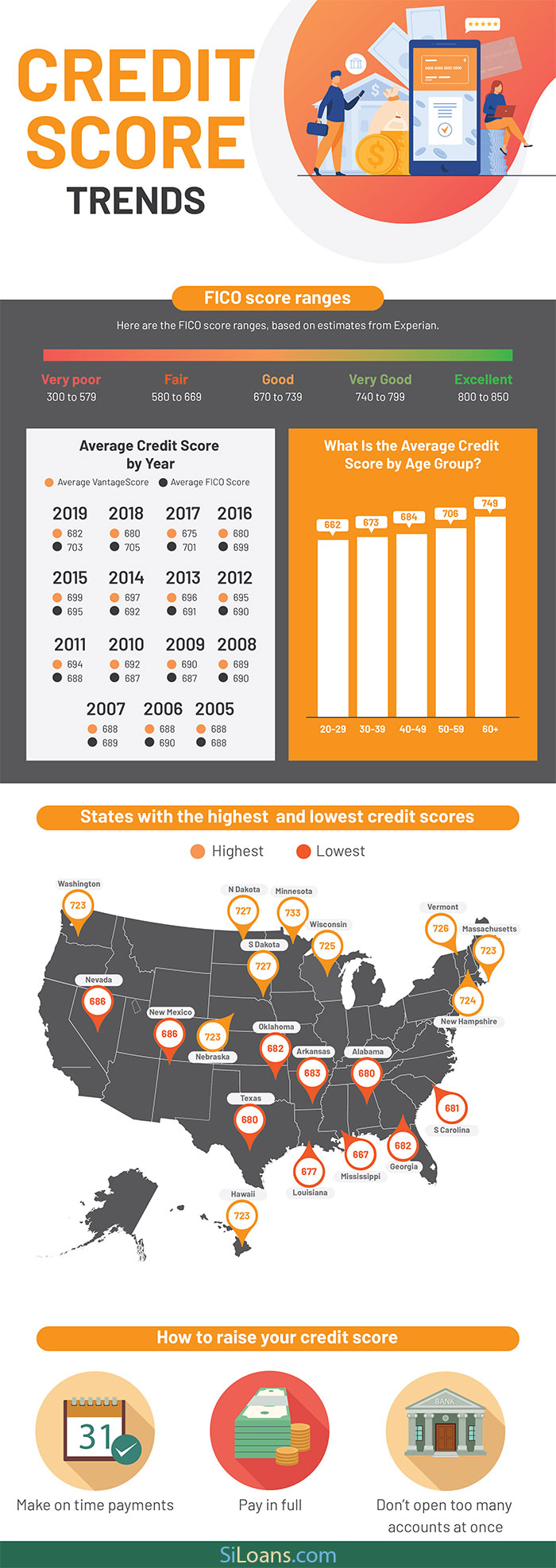

FICO Score Ranges

Using estimates from Experian, a score of 714 to 716 is considered a solid good credit score on FICO’s scoring model.

- Very poor: 300 to 579

- Fair: 580 to 669

- Good: 670 to 739

- Very good: 740 to 799

- Excellent: 800 to 850

How Are Credit Scores Calculated?

FICO Scores are calculated using many different pieces of credit data in your credit report. This data is grouped into five categories: payment history (35%), amounts owed (30%), length of credit history (15%), new credit (10%) and credit mix (10%).

How Are Fico Score Calculated - Infographic

How to Improve Your Credit Score

If you feel far behind from the average score of around 714–715, you aren’t alone. Recent data shows that over one-third of consumers have FICO scores below 715. To help close this gap:

- Pay Your Bills on Time: A solid payment history is one of the biggest factors in your score.

- Reduce Credit Utilization: Aim to keep the ratio of credit used to credit available below 30%.

- Limit New Credit Inquiries: Opening too many new accounts in a short time can lower your score.

- Diversify Your Credit Mix: Having different types of credit (e.g., installment loan and credit card) can help.

What Is the Average Credit Score by Age Group?

Credit Scores by Gender

Average Credit Score by State

Average Credit Score by Income

| Annual Income | Average Credit Score |

|---|---|

| $75,000 or more | 762 |

| $50,000 - $74,999 | 739 |

| $30,001 - $49,999 | 645 |

| $30,000 or less | 592 |

Credit Score Trends Infographic

Last updated on

Chris Miller

Chris Miller