I'm in Urgent Need of a Loan with Bad Credit

You do have options when it comes to qualifying for a personal loan with bad credit. While there are several lending options available to persons with poor credit, the most common type is an unsecured personal loan. Not only can the best bad credit loan providers offer competitive rates and terms, but they may also fund you within one to two business days. Contrary to widespread belief, individuals with poor credit can still obtain funding. When unforeseen needs arise, it is vital to examine all available options before turning to a predatory payday lender. In many cases, even if you have poor credit, a more affordable option may be available.

It's challenging to live with the knowledge that you owe more money than you have at the moment. Personal loans can provide individuals with the resources and assistance they require during those difficult moments. However, seeking relief from personal loans can be difficult if you have low credit. Poor credit might hinder some people from taking advantage of several financial services available to those with good credit.

There are various possibilities for individuals with poor credit to receive a loan. This article will explain what they are and how to obtain them. Additionally, we'll examine several alternative options for obtaining income without taking out a loan and offer tips for increasing your credit score.

What is your credit score?

Everybody understands that a good credit score is better than a bad credit score. On the other hand, many people are uninformed of the elements that affect their credit score, or even what it is. A credit score is a number that indicates how likely you are to repay a loan or line of credit. It is a method of determining your creditworthiness that is used by banks, retailers, utility companies, and a variety of other organizations. Credit scores are a subset of the information contained in your credit report. A credit report is a comprehensive assessment of your financial activities with money and creditors in the past and current. Credit bureaus generate these credit scores by aggregating and analyzing consumer data. Credit reports are generated using this information by the three major credit bureaus.

Creditors and lenders review credit reports. It would be advantageous if you were never charged to examine your credit score or report; credit reporting organizations are required by law to make these available to consumers for free at least once a year. Let's take a look at the information contained in your credit report. The key elements that are examined when calculating your credit score include your credit mix, credit history, credit utilization, and payment history.

A credit history (or credit age) is a record of all credit accounts in your name that have been opened and canceled. A long history of credit accounts in good standing reveals to creditors that you manage credit lines prudently. Part of your credit score is determined by your credit history. Credit mix is a term that refers to the range of credit accounts that you have. Managing a car loan and a credit card is an excellent credit combination. Keeping these accounts open demonstrates to creditors that you are capable of managing another personal loan or credit line appropriately. This component has some impact on your credit score. Individuals with strong credit are viewed as a lower risk by lenders. They are more likely to qualify for low-interest personal loans and help with more favorable loan terms.

Payment history is a comprehensive record of all payments you made to different creditors or other businesses. Potential lenders can determine how you repay loans and whether you do so on time from this information. A payment history marred by missed payments will destroy any credit score quickly. Your payment history has a significant impact on your credit score of any of the five determining elements. This is why we are always urging you to pay your invoices on time. It is critical.

The percentage of available credit that you are now using is called credit utilization. To maintain a decent credit score, credit utilization should be kept low. Having a low utilization rate reflects responsible credit-using practices. This factor also accounts for part of your total credit score.

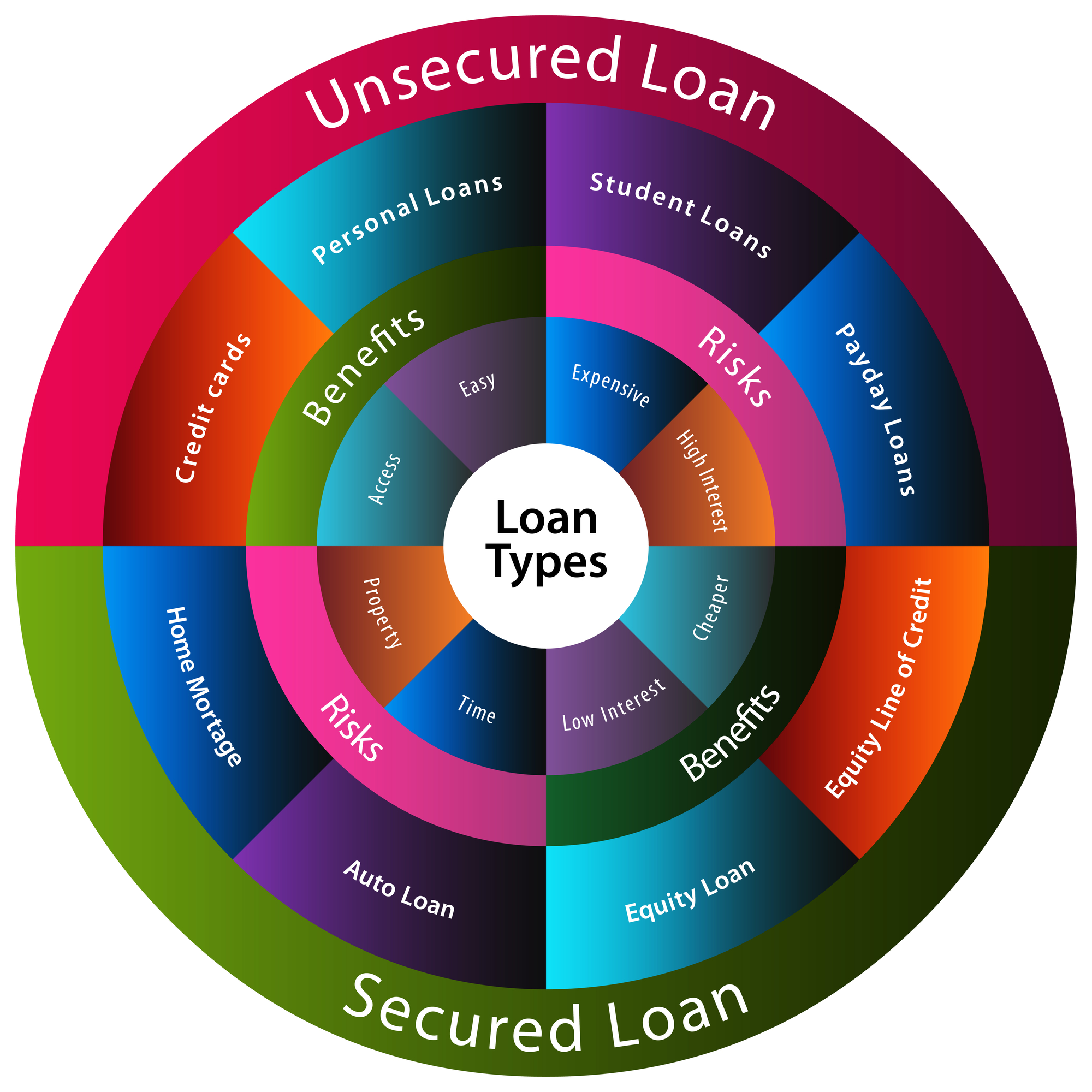

Secured and unsecured loans

Secured loans are those that are secured against collateral. Unsecured loans are those that are not secured against collateral. Secured loans are collateralized by real estate or financial assets such as a home, automobile, or even a savings account. Mortgages and vehicle loans are two types of quick loans that are frequently used. A secured loan often has a lower interest rate than an unsecured loan since the borrower's collateral reduces the risk. If the borrower, for whatever reason, is unable to repay the loan, the borrower may forfeit the collateral to the lending institution.

Unsecured loans are those that are completely based on the borrower's creditworthiness. Unsecured debt includes credit cards and student loans. Due to the absence of collateral, lenders perceive unsecured loans as higher-risk loans. As a result, unsecured loans may carry a higher interest rate and have more restrictive lending terms than secured loans. While secured and unsecured personal loans are available to people with poor credit, a low credit score might still create issues. If you have collateral, consider using it to obtain a personal loan. If you have low credit, collateral may make the difference between rejection and approval.

Loans for Individuals with Poor Credit

While the possibilities accessible to individuals with good credit are different, those with poor credit might still acquire the support they require.

Payday Loans

Payday loans are a form of short-term personal loans designed to assist those who are experiencing short-term cash flow difficulties. It is essentially a cash advance that gives individuals the funds necessary to pay bills and other obligations that accrue before their next payday. Payday loans are a combination of secured and unsecured loans; they do not require collateral and are secured by the borrower's predicted earnings.

Payday lenders are available; many payday lenders operate in-store and online. Payday loans, in most cases, do not require a credit check. Rather than that, all that is required is a legitimate identification, an active checking account, and proof of employment. Loan applications are then processed and monies are disbursed, often within a day or two. Additionally, with some mobile and online payday lenders, many customers can have cash deposited in as little as a couple of hours.

A borrower must visit a payday lender and complete an application to obtain a payday loan. If the borrower is approved, they submit a personal check to the lender for the amount they intend to borrow, plus the lender's origination and interest fees. At the end of the loan term, which is normally between 14 and 30 days, the lender provides the borrower with the loan amount and cashes the check. When an applicant applies for payday loans over the phone or online, he or she must provide their bank account information, which will be used for loan disbursement and repayment by direct deposit or automated withdrawal.

Payday loans are advantageous if they can be repaid within the terms of the loan arrangement. If they are not, the majority of payday lenders will simply roll over any outstanding balance on an existing loan. This is when payday loans might become difficult.

You are responsible for repaying a payday loan on time and in full if you obtain one. Regrettably, many individuals receive payday loans without fully comprehending the repayment structure or the accompanying hazards. Unfortunately, the misconception is an intentional approach used by a large number of unscrupulous payday lenders, many of whom tout payday lending's convenience and accessibility without alerting desperate borrowers. While payday loans may provide instant comfort, if not properly managed, they can soon escalate into financial problems.

Credit union cooperatives

If you are a member of a credit union, you may be able to obtain a personal loan despite your poor credit. Credit unions are not-for-profit cooperative financial institutions that provide financial services to their members. They perform many of the same functions as banks, including the maintenance of checking and savings accounts, the management of investments, and the provision of personal loans. Unlike banks, credit unions are formed and regulated to serve the members' best interests, not to earn profit. Typically, credit unions are created to serve specialized peer groups, such as professionals, labor organizations, and military members. The majority of credit unions offer membership for life.

Credit unions may also offer a payday loan alternative. These loans, like typical payday loans, can be processed and disbursed quickly. However, they come with much lower interest rates and more affordable repayment schedules. Consider your options if you are a credit union member in need of a personal loan.

Peer-to-Peer (P2P) Lending

Peer-to-peer lending is a relatively new kind of financing that enables individuals with bad credit to obtain small loans at lower interest rates and more favorable terms than payday lenders. Additionally, because P2P lenders operate on a wide scale, the majority of their business is conducted online, allowing them to process loans and make payments rapidly.

P2P lending shifts lending power away from traditional financial institutions and toward private investors seeking to profit from lending to individuals in need. P2P lending connects borrowers with lenders who can give borrowers a sliding scale of interest rates based on their financial conditions and the lender's risk. However, these risks are not typically quantified in the same manner as bank risks are (like credit scores). Rather than that, peer-to-peer lenders will assess applicants based on their payment history and income. P2P lenders are paying closer attention to market trends and consumer behavior across a range of investment opportunities to maximize their earnings. Investors seek a return on their capital. This means that P2P lenders are less concerned with your past mistakes and more concerned with your potential to repay their loan.

Home Equity Loans

If you own a home and require an emergency loan, a home equity loan may be a good alternative. Home equity is the difference between the balance of your mortgage and the market value of your home. As an illustration, assume you borrowed money to purchase a property. After a few years, the market value of the residence increases. This corresponds to an increase in your property's equity. That increase can be converted to cash for immediate usage and then repaid over time in conjunction with your current mortgage payments through a home equity loan. If you've ever heard of a home having a "second mortgage," that's a reference to a home equity loan. Because home equity loans are secured by the home, they typically have lower interest rates than loans from a bank or credit union.

Home Equity Line of Credit (HELOC)

A home equity line of credit is another way to access the equity in your home (HELOC). Rather than converting equity to a loan, HELOCs allow borrowers to convert a portion of their home's value to a line of credit. This means that the borrower retains control over how much credit is used, and how much must be repaid.

Emergency Loans

No matter how diligently we save and prepare, we can never be prepared for life. In these instances, emergency loans can be beneficial. Personal emergency loans are intended to pay for unforeseen expenses such as medical bills or urgent car and home repairs. Emergency loans can be paid back in two ways: as a short-term loan or through an installment plan. Emergency loans are applied for in a manner very similar to other sorts of loans. Rather than depending on your credit score, emergency loan providers assess your ability to repay the loan based on your payment history and income.

And, like with any other unsecured personal loan, an emergency loan almost always comes with a higher interest rate than a secured loan. Before applying for an emergency loan, see if you can receive prequalification from a variety of lenders to compare loan terms and interest rates. This loan will be a debt for which you will need to budget, and you want to ensure that you can afford it in addition to covering your basic needs and other obligations.

Obtain a co-signer for your emergency loan if at all possible. Having someone who can assume responsibility for the loan if you are unable to make a payment increases your chances of approval greatly. A co-signer with good to excellent credit and the capacity to make at least three consecutive installment payments on a personal loan would be ideal.

Pawn Shop Loans

When their roles are considered, it is reasonable to assume that pawnshops offer secured emergency loans on the same terms as unsecured loans. In exchange for a valuable object (collateral), the pawnbroker lends the borrower a percentage of the item's value. A pawn shop loan frequently has a monthly interest rate which is the same rate as many credit cards' annual percentage rate. Additionally, if a borrower falls behind on loan payments, they forfeit the item, which becomes the sole property of the pawnbroker to sell. Due to the danger and expense associated with these personal loans, they should be used sparingly.

Automobile Title Loans

Auto title loans, as the name implies, are short-term loans secured by the car's title (evidence of legal possession). Car title loans are frequently granted without requiring a credit check and have an interest rate. Car title loans are normally between two and four weeks in duration and can be repaid in full or in installments. Regrettably, failure to make timely payments may result in the auto title loan company repossessing your vehicle.

Cash Advance on a Credit Card

If you have a credit card, you may be able to convert the available balance to cash. Numerous credit cards offer cash advances that are redeemable at almost any ATM worldwide. While cash advances are convenient, they generally carry an extraordinarily high-interest rate that exceeds the card's purchase APR (Annual Percentage Rate). Additionally, credit card cash advances do not include a grace period during which no interest is charged; interest is assessed at the time funds are withdrawn. If you are desperate enough to use this option, you should be aware that it may be one of the most expensive accessible loan options.

Alternatives to Loans for Individuals with a Poor Credit Score

Personal loans for those with bad credit have stringent conditions, and individuals who are currently in financial problems may choose to avoid them. After all, a loan is simply another payment that must be made. As an alternative to taking out a loan, consider the following practical options:

-

Talk to Your Creditors

If you're considering emergency loans as a result of your inability to pay your debts, you may be able to work out a payment plan with your creditors before spiraling further into debt. Numerous lenders offer payment rescheduling to accommodate pay periods or income fluctuations. Utility companies that distribute gas and electricity routinely engage with consumers to keep their accounts current and to ensure that critical services continue to flow to them. Furthermore, many organizations offer budget billing, which allows customers to pay a fixed monthly fee based on their annual average usage. These businesses are motivated by profit and are willing to collaborate with you. Contact them immediately to determine whether they can assist you with addressing your account concerns.

-

Offer Your Used Items for Sale

Perhaps your current financial situation is precisely what you needed to drive you to organize that massive yard sale you've been planning. If bargaining with your neighbors isn't your cup of tea, consignment shops and vintage clothing enterprises will either purchase your stuff outright or sell them for you (for a fee).

-

Take on a Second Job

When additional funds are required, they must be generated. While grocery stores and warehouses operate 24 hours a day, with evening shifts that can supplement a full-time work schedule if you have reliable transportation, other companies in the gig economy hire independent contractors who set their hours and work when they want. Additionally, the restaurant industry is brimming with opportunities for waiters, bartenders, and cooks to assist with various restaurant tasks. Due to labor shortages, some restaurants are offering record-breaking starting salaries and signing bonuses.

-

Crowdfunding

At times, the most efficient technique of debt relief is simply seeking aid. Online crowdfunding has developed into a wise way to raise emergency funds. Individuals might connect with thousands of donors through sites that can aid them in resolving their financial troubles. Crowdfunding campaigns, because of their reach, enable a huge number of people to give small amounts of money in a short period. The most effective crowdfunding campaigns are those that begin with genuine requests from individuals in genuine need of financial aid.

The Best Way to Improve Your Credit Score

Loans for people with poor credit are subject to restrictions that do not apply to loans for people with strong credit. Keep in mind that your credit score is a computation of how risky lending you money would be. As a result, the only way to raise your credit score is to mitigate the risk associated with doing business with you. However, because it is a prediction of your future behavior, it will only gradually change. Consider the following recommendations for improving your credit score as you work your way out of your current financial difficulties:

Make Bill Payments

Given that payment history accounts for more than a third of your credit score, it's self-evident that the most effective way to improve your credit score is to make on-time payments to lenders and creditors. Additionally, even if you have poor credit (a FICO score of 650 or below), a strong payment history may spell the difference between an approval or denial of a loan or line of credit application.

Assume the Position of a Licensed User

Having your name listed as an authorized user on another person's credit card can help you improve your credit score. Your credit score can be improved simply by becoming a user; you are not obliged to make any payments or even purchases on the account. However, many credit cards allow the principal account holder to set spending limits for additional users. Because you will not be the primary account holder making the card payments, this technique will have little impact on your credit score. Additionally, this will improve your credit score only if the account is kept current. As a result, it is preferable to work with someone who has a favorable credit score and adheres to appropriate financial practices.

Dispute Inaccuracies in Your Credit Reports.

When you acquire access to your credit report (remember, it's entirely free!), you must conduct an in-depth study of the information. Credit reports may contain a range of errors, ranging from paid accounts being shown as delinquent to the listing of funds that do not belong to you. Any inaccuracy in your report could have a detrimental effect on your credit score. Maintain attention and make regular assessments of your entire file to ensure that your account displays just your credit activity.

Secured Credit Card

Credit lines on unsecured credit cards are determined by the cardholder's creditworthiness. A secured credit card is used to establish a line of credit that is funded (or backed) by money provided by the cardholder/borrower in the form of a deposit to the credit card business. A safe credit card can help individuals with weak credit build solid spending habits and credit management skills. Making on-time payments and keeping a low credit utilization rate will help consumers with poor credit improve their scores.

Personal loans for individuals with negative credit are available and can be utilized for a variety of objectives in addition to addressing immediate cash demands. By allowing you to borrow only what you need and making on-time payments, a personal loan can help you improve your credit score. With a better credit score, you'll have more choices for aid if your financial situation worsens. When you are in desperate need of a loan, you may feel as if you have little time to make the greatest financial decision for yourself, your family, and your financial health. When bills are due and fundamental requirements must be satisfied, it is natural to choose the quickest route available. The consequences can be considered at a later date.

Before doing so, consider the loan's long-term implications. Even if you are resolving an urgent problem, you must consider the future problems you may create for yourself. A loan is a debt that will follow you long after you have resolved your immediate financial issues. To break the debt cycle, you must develop a good financial strategy that tackles both current and future issues.

Before you choose a negative credit loan, it's vital to understand the many types of loans available, the qualification conditions, and the related expenses. Having bad credit does not automatically stop you from receiving money. Consider a lender who charges a reasonable interest rate and gives reasonable repayment terms.

A Step-by-Step Guide to Obtaining a Loan Despite Having Poor Credit

Loans for people with bad credit are available in a variety of ways, like any other type of loan. Several of the most common types of loans for those with poor credit include the following: Secured loans include mortgages, auto loans, home equity loans, and home equity lines of credit. A secured loan is ideal if you require funds to purchase a car or a house, or if you require funds to repair or renovate your current home. Secured loans are often the least expensive type of bad credit loan because they are secured by collateral.

Numerous lenders, including banks, credit unions, alternative internet lenders, and peer-to-peer (P2P) lenders, offer unsecured personal loans to those with poor credit. This type of loan does not demand security (e.g., your car or home), and it is normally repaid within two to seven years. Unsecured loans, on the other hand, are usually more expensive than secured loans, as no collateral is required.

Numerous credit cards are available to individuals with poor credit. Numerous modern credit cards also have features that aid in credit repair. This type of negative credit loan may be advantageous if you require a credit card and are capable of paying it off each month in full. Bear in mind that credit card annual percentage rates are normally high, and you should make every effort to pay off the balance as early as possible to avoid paying exorbitant borrowing costs.

Several credit card issuers offer cash advances if you require money instantly. On a case-by-case basis, banks and other alternative internet lenders may also offer short-term cash advance loans. Cash advances are more expensive than secured or unsecured personal loans and often carry exorbitant interest rates.

Bear in mind that payday loans typically contain extremely high-interest rates, making them extremely risky and difficult to repay. It's all too easy to become caught up in a payday loan cycle. For these reasons, it is recommended to avoid payday loans in favor of other forms of financing.

How to Choose a Loan for Bad Credit

Before applying for a negative credit loan, it is vital to consider why you require the cash, how fast the debt will be repaid, how much you can pay, and how quickly the funds are required. Why do you require the loan? Before applying for a loan, you should consider why you require the funds. One of the key reasons for this is that the form of loan that is most appropriate for you is greatly reliant on the purpose for which the funds are meant. A secured loan, for example, is excellent if you intend to acquire an automobile. In comparison, an unsecured loan is appropriate if you want automotive maintenance and do not wish to use it as collateral.

After establishing why you require the cash, the next step is to determine how quickly you can repay it. The sooner you repay the money you borrowed, the less monthly interest you will pay. For example, if you can afford car repairs until your next paycheck arrives, a credit card may be advantageous. If, on the other hand, you anticipate that paying for repairs will take a year or two, an unsecured personal loan for bad credit may be a better option.

Not only is it necessary to determine the loan's repayment schedule, but you must also examine your financial status. This can be accomplished by generating a monthly budget that takes all of your income and expenses into consideration. If you're having difficulty creating a budget, a credit counselor can help. Credit counseling services give free financial education.

When you require financial assistance, Finally, it is vital to assess when the funds will be required. While there are scenarios in which you can acquire funds quickly (for example, many unsecured personal loans offer next-day funding), this is not always the case. For example, it may take 45 to 60 days or longer to fund a home loan. Plan as much as possible to ensure that you have the finances you need when you need them.

Frequently Asked Questions

What Are Bad Credit Loans?

Bad credit loans are available to individuals with low credit scores. While negative credit loans come in several forms, the most common is an unsecured personal loan. Unsecured personal loans for those with poor credit usually feature fixed interest rates and repayment terms of two to seven years. Furthermore, this type of bad credit loan is quite simple to secure since many lenders offer same-day cash.

What Should My Interest Rate Be If I Have Poor Credit?

All lenders develop their terms and conditions for loan acceptance and pricing (including credit score minimums). As a result, estimating the annual percentage rate (APR) you'll pay on a personal loan if you have negative credit is difficult. If you have a low credit score, you should expect to be offered rates at the top of the market.

Additionally, you may come across lenders who provide personal loans for those with bad credit that are "guaranteed acceptance" or "no credit check." Such guarantees should serve as a warning indication. Respectable lenders never give these assurances or even suggest that you are likely to qualify for a loan before you apply.

Where Can I Get a Personal Loan Despite My Poor Credit Situation?

Obtaining a personal loan with bad credit may be challenging. Nonetheless, you may encounter numerous lenders willing to cooperate with you (albeit typically at a higher interest rate). If you're looking for personal loan options with bad credit, you may want to consider two common loan types.

Online personal loans for people with poor credit: Your loan application is accepted by online lending networks, which connect you with lenders who may approve you for a personal loan. Often, you can submit a single initial application and compare offers from multiple lenders.

Direct lenders for those with bad credit: Personal loans that are issued directly by the financial institution that approved you are referred to as direct loans. Local banks and credit unions, as well as online banks and direct lenders, may be included. If you have bad credit, it is generally advised that you apply only to direct lenders who are willing to engage with credit-challenged borrowers.

Personal Loans vs. Payday Loans

If you have low credit, small payday loans may be easier to apply for. They do, however, come at a high cost. If you qualify for a personal loan despite a low credit history, you may be able to borrow money at a much more affordable rate than you would with a payday loan. Even an interest rate of nearly 36%, the maximum possible for the majority of personal loans, is much less expensive than the normal costs imposed by payday lenders. Additionally, an increasing number of community credit unions offer alternative payday loans. These loans may help clients with bad credit obtain short-term financing.

Individual Loans vs. Individual Loans with Installment Payments

The terms "personal loan" and "personal installment loan" are commonly used interchangeably. While a personal line of credit (LOC) can be used to borrow money, a LOC is a revolving account. The majority of financial professionals would classify a LOC as a business loan rather than a personal loan. You may also have difficulty qualifying for a LOC if your credit is poor. Installment loans, like personal loans, are referred to by their mode of operation. You borrow a predetermined sum of money and repay the lender in predetermined installments (plus interest and fees). If the lender reports the account to the credit bureaus, a personal loan will typically appear on your credit report as an installment account.

Individual Loans vs. Peer-to-Peer Loans

Another sort of personal installment loan is a peer-to-peer (P2P) loan. If you qualify for a peer-to-peer loan, however, the funds you borrow are not usually supplied by a bank or lender. Typically, you are lent money by an investor or group of investors. As is the case with personal loans, many P2P lenders will disclose your account to credit bureaus. Additionally, you may be required to have a minimum credit score to be approved (though every P2P network and investor may have their approval criteria).

To qualify for a peer-to-peer loan, you must apply through a website that connects potential borrowers and investors. However, you should undertake some research before making a commitment (or even applying). It's prudent to familiarise yourself with the rates, fees, and terms being offered and to compare them to other available options. While P2P loans may have fewer acceptance conditions than traditional bank loans, you may incur a higher interest rate and expenses as a result.

References:

- Annual percentage rate (APR)

- What is the Process of Obtaining a Payday Loan?

- How Do Payday Loans Work?

- Payday Loan Facts

- What is a Title Loan?

Last updated on

Tiffany Wagner

Tiffany Wagner